Maximize 179

This feature is available in Enhanced Asset Management.

The Maximize 179 feature is a quick way to populate several current year assets with a section 179 deduction equal to the Cost (times bus %). Certain options are provided to control the order in which the 179 deduction is applied to possibly provide a tax advantage. The program will remember the options you selected on a client by client basis. If no options are selected, the system will apply the section 179 deduction up to the Cost limit based on the asset list order. Some options will be checked by default when you open the program.

Remember that available 179 deductions can be limited by business income that will be calculated only in the tax return, so further edits may be needed in the tax return environment.

Features of the Maximize 179 Dialog

- The Maximize 179 button allows you to populate all of the assets seen in the dialog's list with section 179 at the same time.

- The Options button allows you to set preferences for the order in which the section 179 deduction is applied.

- The Clear All button removes all of the section 179 deduction entries.

- The asset list includes only current year assets that qualify for a section 179 deduction.

- You can sort the list by any column in the dialog.

- The Max button on each asset allows you to set the maximum 179 deduction just for that asset.

- Cost/Basis Grand Total shows you the overall cost of the qualifying assets. If the cost threshold is exceeded, the program calculates the reduced dollar limit.

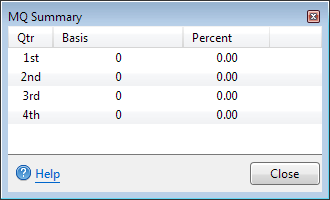

- MQ summary shows the current-year asset total basis by quarter for mid-quarter determination.

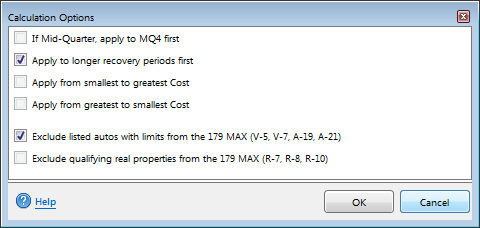

Options/Calculation Options

Calculation Options help determine the calculations used for Section 179 amounts.

Calculation Options dialog box

- If Mid-Quarter, apply to MQ4 first.

- In the determination of whether mid-quarter convention must be used, cost amounts expensed under Code Sec. 179 are disregarded (Reg. §1.168(d)-1(b)(4)). By applying section 179 to the assets that would otherwise need to use MQ4 convention, you are reducing the basis of those assets to 0.

You can launch the Mid-Quarter (MQ) Summary from the bottom right corner of the Maximize 179 dialog.

- Apply to longer recovery periods first.

Assets with a shorter life are more likely to be kept in service for the entire recovery period so deductions can be recovered through normal depreciation.

- Apply from smallest to greatest cost.

- Apply from greatest to smallest cost.

These options are simply user preference:

- Exclude listed autos with limits....(V-5, V-7, A-19, A-21)

A section 179 deduction will not be applied to these asset types if either of these options is checked, but the cost will still be considered in the cost limitation calculation because they qualify for a Section 179 deduction.

Maximum Amount of Section 179 to a Single Asset

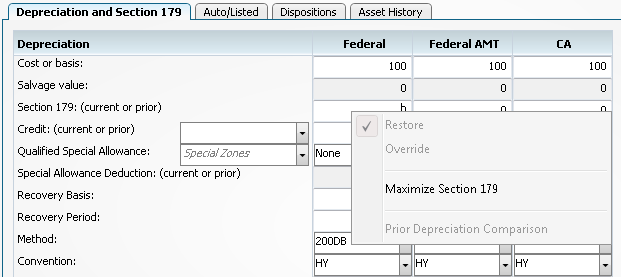

To assign the maximum amount of Section 179 to a single asset, use the following steps:

- Right-click in any field on the Depreciation and Section 179 tab, and select Maximize Section 179. The Section 179 field is automatically populated with the maximum allowed amount.

Maximize 179 dialog box

- Click the Maximize Section 179 menu.

- The program will insert the maximum section 179 amount for the individual asset.

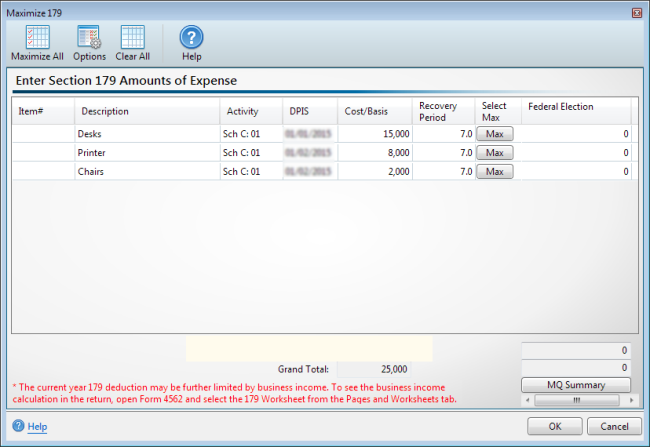

Multiple Assets with Section 179

To assign the maximum amount of Section 179 to multiple assets, use the following steps:

- Click the Maximize 179 icon on the toolbar.

Maximize 179 dialog box

- Click Maximize All on the toolbar. ATX sets the Federal Election column, calculations for all assets listed.

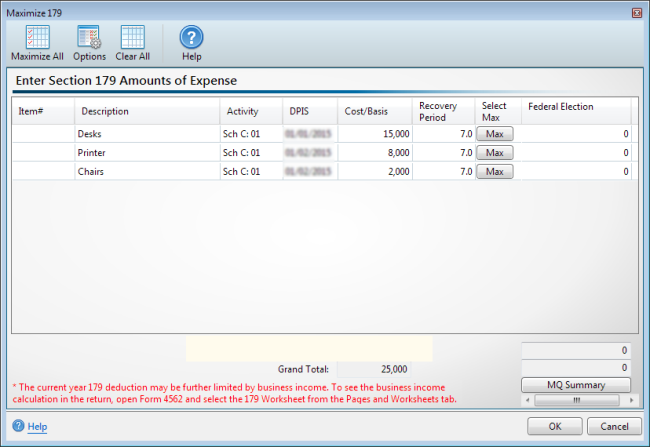

Clear All Section 179 Deduction Amounts

To clear all Section 179 Deduction amounts:

- Click the Maximize 179 icon on the toolbar.

Maximize 179 dialog box

- Click Clear All on the toolbar. ATX sets the Federal Election column to zero, clearing the Section 179 calculations for all assets listed.

The current year 179 deduction may be further limited by business income. To see the business income calculation in the return, open Form 4562 and select the 179 Worksheet from the Pages and Worksheets tab.

MQ Summary

To view your Mid Quarter Summary for an asset, click the MQ Summary button from the Maximize 179 dialog box. This information is for display only. Click Close to close out of the MQ Summary.

Mid Quarter Summary